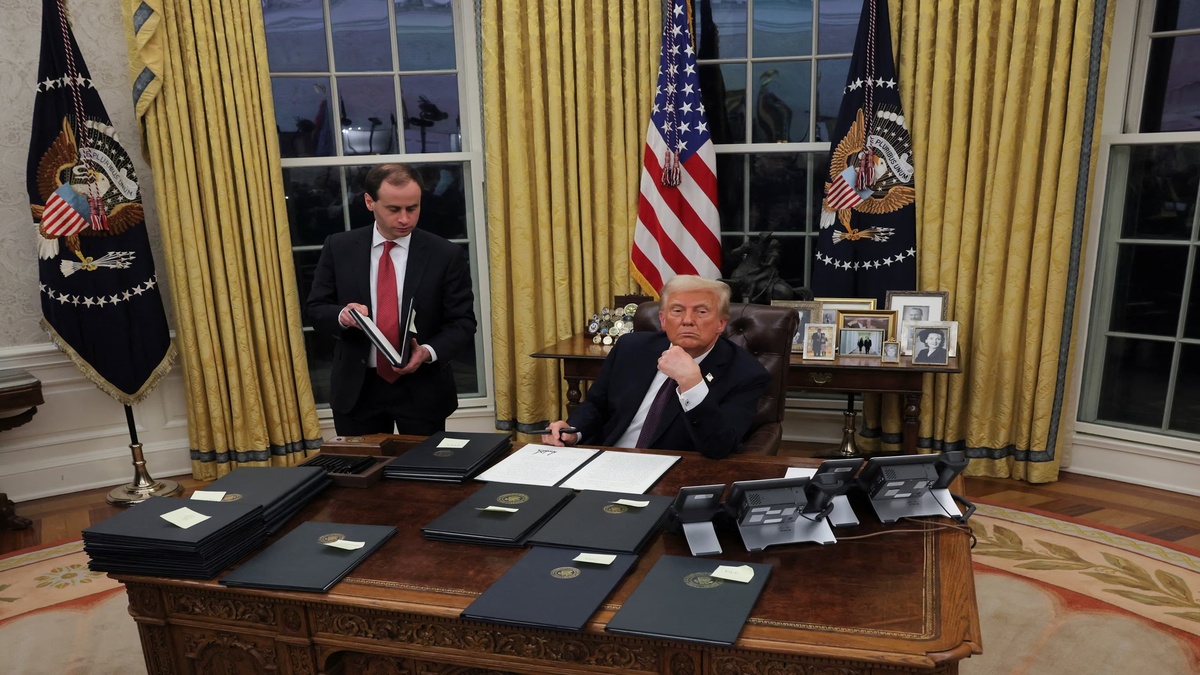

Donald Trump’s Reciprocal Tariff Policy: An Indian Perspective

Donald Trump, the 45th President of the United States and a prominent figure in the 2024 U.S. presidential election cycle, has long championed a trade philosophy rooted in reciprocity. His proposed reciprocal tariff policy, which gained traction during his first term (2017–2021) and remains a cornerstone of his economic agenda, seeks to impose tariffs on imports from countries that levy high duties on American goods. As of April 3, 2025, with Trump’s influence still looming large in U.S. politics, this policy has significant implications for India, a key trading partner of the United States. From an Indian perspective, the reciprocal tariff approach presents both challenges and opportunities, shaped by the dynamics of bilateral trade, geopolitical considerations, and India’s own economic priorities.

Understanding Reciprocal Tariffs

Trump’s reciprocal tariff policy is based on the principle of “mirror reciprocity.” If a country imposes, say, a 20% tariff on U.S. exports, the U.S. would retaliate with an equivalent 20% tariff on that country’s imports. This departs from the multilateral, rules-based trade system championed by institutions like the World Trade Organization (WTO), favoring instead a bilateral, tit-for-tat approach. During his first term, Trump implemented this philosophy through actions like the Section 232 tariffs on steel (25%) and aluminum (10%) in 2018, citing national security concerns, and the trade war with China, which saw tariffs escalate on billions of dollars’ worth of goods.

For India, this policy is not abstract. In 2019, the U.S. revoked India’s status under the Generalized System of Preferences (GSP), a program that allowed duty-free entry for certain Indian exports. Trump justified this by arguing that India imposed high tariffs—sometimes exceeding 100%—on U.S. goods like motorcycles and whiskey. India retaliated with tariffs on 28 U.S. products, including almonds, apples, and chemicals. This tit-for-tat exchange offers a glimpse into how reciprocal tariffs could play out under a renewed Trump administration.

India-U.S. Trade: The Current Landscape

India and the U.S. share a robust trade relationship. In 2023, bilateral trade in goods and services reached approximately $191 billion, according to the U.S. Trade Representative (USTR). The U.S. is India’s largest export market, accounting for about 18% of India’s total exports, valued at $83 billion in goods like pharmaceuticals, textiles, and IT services. Meanwhile, India imports $37 billion in U.S. goods, including energy products, aircraft, and machinery, resulting in a trade surplus of $46 billion in India’s favor.

However, tariff disparities have long been a point of contention. India’s average applied tariff rate is around 17%, significantly higher than the U.S.’s 3.4%, per WTO data. Specific sectors highlight the gap: India imposes duties of up to 150% on agricultural goods and 60–100% on automobiles, while U.S. tariffs on Indian exports like apparel and jewelry remain low. Trump has repeatedly called out such imbalances, labeling India a “tariff king” in 2018. A reciprocal tariff policy could target India’s surplus and high-duty sectors, potentially disrupting this trade dynamic.

Implications for Indian Exports

A reciprocal tariff regime under Trump could hit Indian exporters hard. Pharmaceuticals, a $25 billion export industry to the U.S., might face new barriers if the U.S. mirrors India’s duties on American drugs (around 10–20%). Similarly, textiles and apparel, which account for $10 billion in exports, could see costs rise, eroding competitiveness against rivals like Vietnam or Bangladesh. The IT services sector, while not directly tariffed, could face indirect pressure if U.S. firms cut costs in response to broader trade tensions.

The loss of GSP benefits in 2019 already cost Indian exporters $260 million annually, per India’s Ministry of Commerce. A broader reciprocal tariff framework could amplify this, especially if applied to high-volume sectors. Small and medium enterprises (SMEs), which dominate India’s export base, might struggle to absorb these costs, lacking the scale to pivot markets quickly.

Opportunities for India

Yet, reciprocal tariffs are not a one-way street. India could leverage the policy to negotiate better access to the U.S. market. For instance, lowering tariffs on U.S. goods like Harley-Davidson motorcycles (currently 50%) or California almonds (previously hiked to 42%) could prompt the U.S. to ease restrictions on Indian goods. During Trump’s first term, India successfully negotiated exemptions from steel and aluminum tariffs by offering trade concessions, a precedent that could guide future talks.

Moreover, India’s growing role as a manufacturing hub under the “Make in India” initiative aligns with Trump’s push to diversify supply chains away from China. In 2023, U.S. imports from India grew by 7%, while those from China declined, per U.S. Census Bureau data. A strategic tariff reduction on U.S. inputs like semiconductors or energy could boost India’s electronics and renewable energy sectors, deepening economic ties.

Geopolitical Context

Trump’s reciprocal tariffs must also be viewed through a geopolitical lens. The U.S. sees India as a counterweight to China in the Indo-Pacific, a partnership formalized through the Quad (U.S., India, Japan, Australia). In 2025, with U.S.-China tensions still simmering, Trump might temper tariff aggression toward India to preserve this alliance. During his 2020 visit to New Delhi, Trump praised Prime Minister Narendra Modi and avoided escalating trade disputes, suggesting pragmatism could override ideology.

However, India’s protectionist streak—evident in its withdrawal from the Regional Comprehensive Economic Partnership (RCEP) in 2019—might clash with Trump’s demands for open markets. Balancing “Atmanirbhar Bharat” (self-reliant India) with U.S. trade expectations will test India’s diplomatic agility.

Economic Risks and Domestic Impact

On the flip side, reciprocal tariffs could strain India’s economy. Higher U.S. duties might shrink India’s trade surplus, impacting foreign exchange reserves, which stood at $670 billion in March 2025, per the Reserve Bank of India. A stronger dollar, fueled by U.S. tariff-driven growth, could widen India’s trade deficit, already $250 billion in 2023. Inflationary pressures from costlier U.S. imports like oil (India imports 10% of its crude from the U.S.) could also hit consumers.

Domestically, Indian industries reliant on U.S. demand—such as gems and jewelry, employing millions—might face layoffs. Conversely, sectors like agriculture, shielded by high tariffs, could remain insulated unless India concedes ground in negotiations.

The Path Forward

For India, navigating Trump’s reciprocal tariffs requires a dual strategy: defensive and proactive. Defensively, India must protect its export-driven sectors through subsidies or diversification to markets like the EU or ASEAN. Proactively, it should engage the U.S. in bilateral talks, offering targeted tariff cuts to secure concessions. The India-U.S. Trade Policy Forum, revived in 2021, provides a platform for such dialogue.

Historical data suggests flexibility works. In 2019, India avoided a full-blown trade war by calibrating its retaliation to U.S. actions. With Trump’s return a possibility in 2025, India must prepare for a policy that blends economic nationalism with strategic opportunism. The stakes are high: a misstep could cost billions, while adept negotiation could cement India’s place in a shifting global order.

In conclusion, Donald Trump’s reciprocal tariff policy poses a complex challenge for India. It threatens export growth but also opens doors for deeper U.S. engagement. As of April 3, 2025, with global trade at a crossroads, India’s response will shape not just its economic future but its standing in a world where reciprocity increasingly defines the rules of the game.