In a move that’s set to reshape India’s taxation landscape, the Indian Government has rolled out advertisements across leading newspapers today, September 4, 2025, heralding the arrival of “Next-Gen GST” or GST 2.0. This ambitious reform, stemming from the recommendations of the 56th GST Council Meeting, promises to simplify the Goods and Services Tax (GST) system, making it more efficient, consumer-friendly, and aligned with the nation’s economic transformation goals. As External Affairs Minister S. Jaishankar aptly put it, this overhaul will have a “huge impact on the transformation story underway in India.”

What is Next-Gen GST?

Next-Gen GST represents a significant evolution from the original GST framework introduced in 2017. Dubbed a “historic Diwali gift to the nation,” it aims to streamline the tax structure by reducing the number of slabs and rationalizing rates on essential goods and services. The reform was finalized during the GST Council Meeting held on September 3-4, 2025, chaired by Finance Minister Nirmala Sitharaman.

At its core, the new system replaces the existing four major slabs (5%, 12%, 18%, and 28%) with a simplified two-tier structure: 5% for essentials and 18% for most other goods and services. Additionally, a new 40% slab has been introduced specifically for sin goods (like tobacco and aerated beverages) and luxury items, ensuring that the tax burden shifts away from everyday necessities.

Key Changes and Rate Reforms

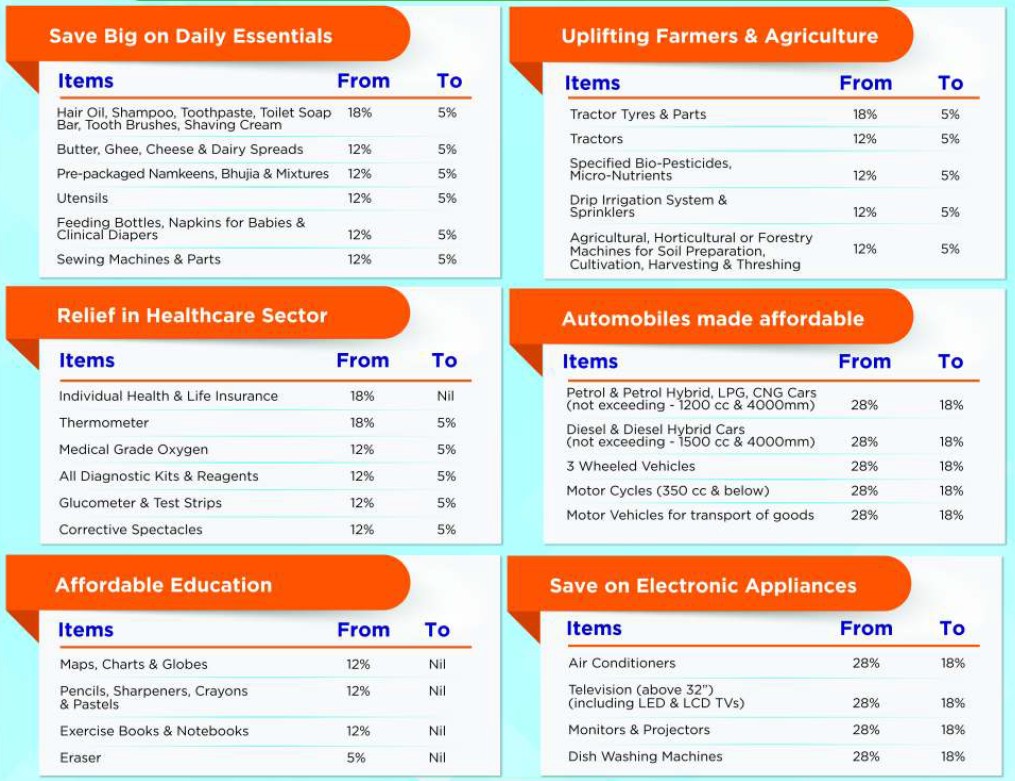

The GST Council has approved rate reductions across various categories to ease the cost of living. Here’s a breakdown of some notable changes:

- Essentials and Daily Goods: Items like food grains, vegetables, milk, and unpacked staples will continue at 0% or move to the 5% slab, significantly lowering prices for consumers.

- Healthcare and Education: Medicines, health insurance, and educational services see reduced rates, with many falling under 5% to make them more accessible.

- Consumer Durables: Electronics such as TVs, ACs, and home appliances, along with automobiles, will benefit from lower taxes, dropping from higher slabs to 18% in many cases.

- Agriculture and Environment: Farm equipment and eco-friendly products get tax relief to boost sustainability.

- Luxury and Sin Goods: High-end cars, jewelry, and tobacco products will attract the new 40% rate, generating additional revenue for the government.

Implementation Timeline

The big question on everyone’s mind: When does this kick in? According to the GST Council’s recommendations, the new rates for most goods (except pan masala and certain tobacco products, which remain unchanged) will come into effect from September 22, 2025. Changes to service rates will also be implemented on the same date. This gives businesses and consumers about two weeks to prepare for the transition.

The rollout is strategically timed post the council meeting, allowing for necessary amendments to GST laws and IT systems. Experts suggest this buffer period will minimize disruptions, unlike the initial GST launch.

Benefits for the Economy and Citizens

This reform is poised to deliver multiple advantages:

- Simplified Compliance: Fewer slabs mean easier tax filing and reduced disputes for businesses.

- Boost to Consumption: Lower taxes on essentials and durables could stimulate spending, aiding economic recovery.

- Revenue Neutrality: While essentials get cheaper, higher rates on luxuries ensure the government’s revenue stream remains robust.

- Equity Focus: By prioritizing relief for lower and middle-income groups, it aligns with the Prime Minister’s vision of a “Next-Generation GST” as highlighted in his Independence Day speech.

Industry leaders have welcomed the move, predicting it will enhance India’s global competitiveness and attract more investments.

Challenges Ahead

While the reform is largely positive, potential hurdles include initial supply chain adjustments and ensuring seamless IT integration on the GST Network. Small businesses may need support to adapt, and the government has hinted at awareness campaigns in the coming weeks.

Conclusion

The Next-Gen GST is more than just a tax tweak—it’s a step towards a modern, principled tax system that supports India’s growth narrative. As advertisements flood newspapers today, it’s clear the government is gearing up for a smoother economic ride. Stay tuned to buzzchronicles.in for updates on how this unfolds. What are your thoughts on these changes? Drop a comment below!

Disclaimer: This article is based on official announcements and is for informational purposes only. Consult a tax professional for personalized advice.