In an era where digital payments dominate, cheques might seem like a relic from the past. But for many businesses, individuals, and institutions in India, they remain a trusted mode of transaction. The Reserve Bank of India (RBI) has stepped up to modernize this system with new guidelines that promise lightning-fast clearances. If you’ve ever waited anxiously for a cheque to clear, this update is a game-changer. Let’s dive into the details of the RBI’s new Continuous Clearing and Settlement on Realisation in the Cheque Truncation System (CTS).

The Old Way: Why Cheque Clearance Took So Long

Before these changes, India’s cheque clearing operated under the Cheque Truncation System (CTS), introduced back in 2010 to digitize the process. Instead of physically transporting cheques between banks, CTS uses scanned images and electronic data for verification. However, it relied on batch processing—cheques were grouped and cleared in fixed sessions, typically once or twice a day.

This meant a cheque deposited today might not clear until the next working day (T+1), or even longer in some cases, extending up to two working days for full settlement. For outstation cheques, delays could stretch to 7-14 days depending on the location. Factors like holidays, bank cut-off times, and manual interventions added to the wait, causing inconvenience for payees needing quick access to funds and increasing the risk of bounced cheques due to timing mismatches.

The batch system, while efficient for its time, couldn’t keep pace with today’s fast-moving economy, where instant transfers via UPI are the norm.

The New Guidelines: What’s Changing for Faster Clearance?

The RBI has shifted from batch processing to a “continuous clearing” model, where cheques are scanned, presented, and processed throughout business hours without waiting for specific batches. This is called Continuous Clearing with Settlement on Realisation.

Key changes include:

- Real-time Scanning and Presentation: Banks now scan cheques immediately upon deposit (during 10:00 AM to 4:00 PM on working days) and send images to the drawee bank for confirmation.

- Settlement on Realisation: Funds are credited to the payee’s account the same day upon successful verification, with settlement happening within one hour of confirmation.

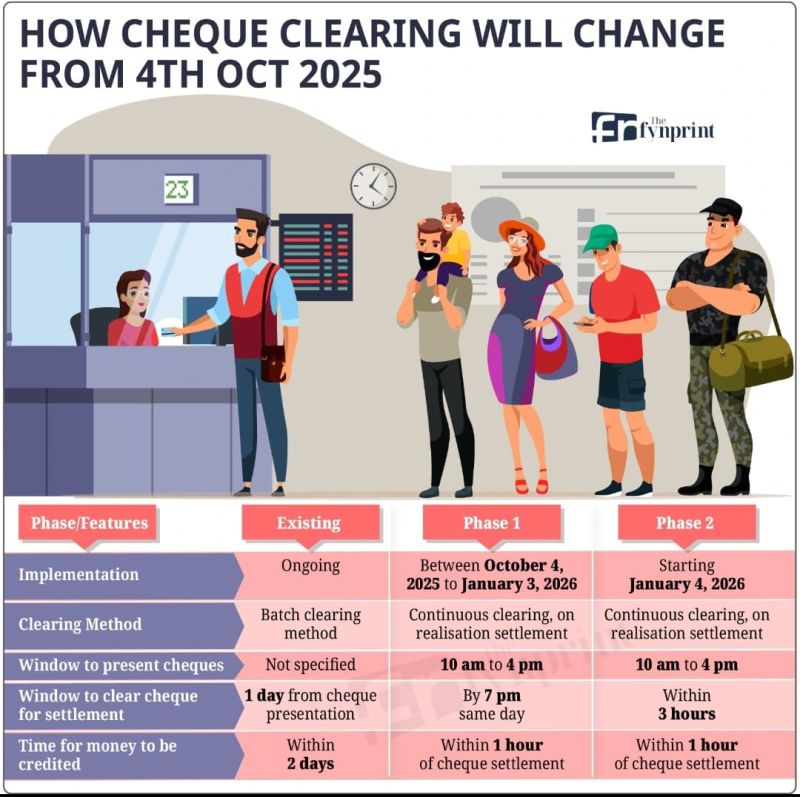

- Phased Rollout: To ensure smooth adoption, the system is being implemented in two phases.

- Phase 1 (October 4, 2025, to January 2, 2026): Cheques get a positive or negative confirmation by 7:00 PM on the same day. Unconfirmed cheques are treated as rejected.

- Phase 2 (Starting January 3, 2026): A stricter T+3 hours window applies—for example, a cheque presented at 10:30 AM must be confirmed by 1:30 PM.

These updates build on the existing CTS infrastructure but eliminate batch delays by enabling ongoing processing, making cheque payments more predictable and efficient.

When Was the Rule Made and Implemented?

The RBI announced these guidelines on August 13, 2025, via Circular No. RBI/2025-26/73 CO.DPSS.RLPD.No.S536/04-07-001/2025-2026. The move aims to align cheque processing with modern payment speeds, reducing the typical clearance time from days to mere hours.

Implementation kicked off with Phase 1 on October 4, 2025—just days before this blog’s publication date of October 15, 2025. By now, many banks have adapted, and customers are already experiencing quicker credits. Phase 2 will tighten the timelines further from January 3, 2026.

Why This Matters: Benefits for You and the Economy

This overhaul isn’t just about speed—it’s about efficiency and trust in the banking system. Faster clearances mean:

- Quicker Access to Funds: Payees get money in their accounts on the same day, improving cash flow for businesses and individuals.

- Reduced Risks: Shorter windows lower the chances of fraud or insufficient funds issues, as issuers must ensure balances are available promptly.

- Boost to Digital India: While promoting digital alternatives, the RBI is ensuring traditional methods aren’t left behind, making banking more inclusive.

- Economic Impact: Smoother transactions can accelerate commerce, especially in sectors reliant on cheques like real estate, insurance, and government payments.

However, depositors should note that cheques must be presented within business hours for same-day processing, and issuers need to maintain sufficient balances to avoid bounces.

Wrapping Up: A Step Towards Seamless Banking

The RBI’s new cheque clearance rules mark a significant leap in modernizing India’s payment ecosystem. Announced in August 2025 and rolled out from October 4, 2025, this shift from sluggish batch processing to continuous, same-day settlements addresses long-standing delays and brings cheques closer to the instant gratification of digital payments. If you’re still using cheques, rest assured—your waits just got a lot shorter!

Stay tuned to BuzzChronicles.in for more updates on finance, tech, and everything buzzing in India. Have you noticed faster cheque clearances yet? Share your experiences in the comments!